Tax day is coming up, and like many other families we plug a bunch of numbers into our tax software and pay/receive whatever it tells us to do. While this is effective, it doesn’t allow for much understanding of what is going on behind the scenes of how the numbers are calculated.

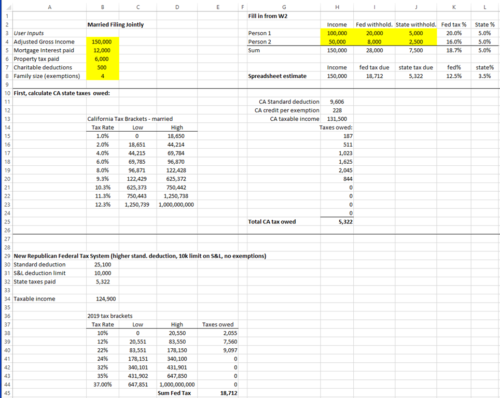

Also, if a family has two earners, this spreadsheet could help explain why there was a refund/underpayment by breaking out the federal and state tax rate each person paid, and compares that to what the tax rates were overall for the couple.

We repurposed the spreadsheet used for our post Will the Tax Cuts and Jobs Act make you pay more or less in taxes?, so look there for more details on how it was built. Note that this spreadsheet only works for a married couple filing in California (feel free to tweak it for your own needs. Also of course this is highly simplified with no investment income, etc).

Here’s an example, we filled in $100k income for person 1, $20k federal withholding, and $5k state withholding from their W2. We also filled in their spouse’s $50k income and withholding, along with 12k in mortgage interest, $6k in property tax and $500 in charitable contributions, along with 2 kids”:

They would have owed roughly $18.7k in federal tax and $5,322 in state tax, for a 12.5% federal rate and 3.5% state rate. We can see both spouses over-withheld by 7.5% and 3.5% roughly in this fictional example.

Check out the spreadsheet here: Tax Estimator