Today’s post will be an application of our 2019 house rent vs. buy spreadsheet. With the recent jump in mortgage rates to near 6%, we wonder how much house prices are supposed to be down (in theory) if a buyer were perfectly rational and would demand the same internal rate of return from their housing purchase decision.

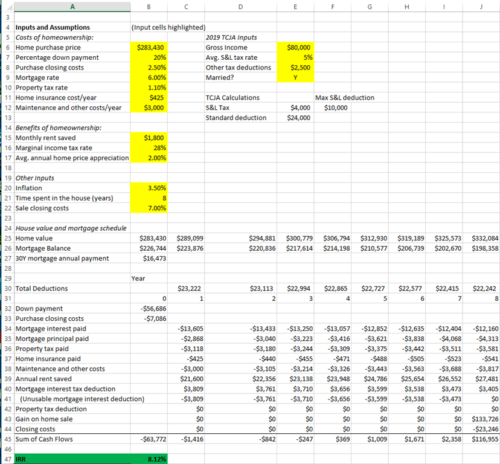

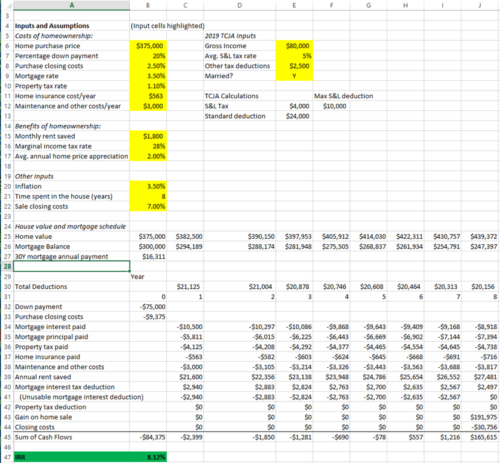

We’ll pull up our mortgage spreadsheet and enter in some very average metrics for the US:

Home price: $375k, Median rent: $1,800/month, time spent in house before selling: 8 years, rent and other cost inflation: 3.5%, down payment: 20%

We’ll start our mortgage rate at 3.5%, and found the IRR to be 8.12%.

With a mortgage rate of 6%, in order to keep the IRR of buying the house at 8.12%, the house price would have to be $283,430, which is 24% less than the original house price!