A very quick post today (sorry for the long hiatus; life has been pretty hectic). There has recently been a lot of buzz from Alexandria Ocasio-Cortez’ comments on instituting a 70% marginal tax rate on very high incomes.

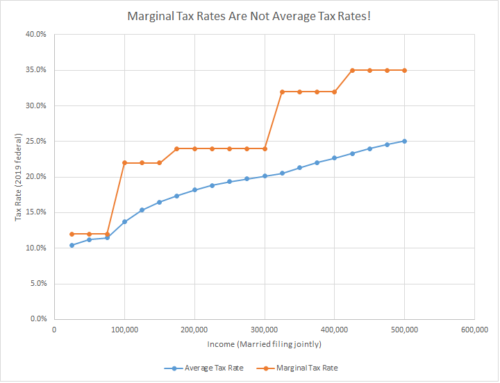

While this site avoids commenting on rising income equality, populism, and the balance between capitalism’s incentives and growth versus its inequality, a spreadsheet is a great way to highlight the confusion between marginal and average tax rates.

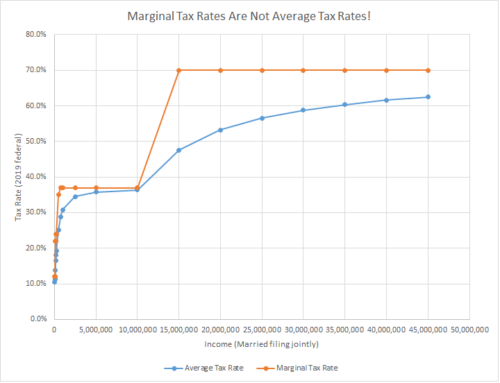

Let’s plot average tax rate by income and throw in a 70% tax rate at $10 million for kicks (preparation?), to see the difference between marginal and average tax rates.

As a reminder, we have covered the logic behind how to calculate taxes, and showed a detail example of whether a married California couple would pay more or less taxes as a result of the Tax Cuts and Jobs Act.

Here’s how it would look with very high incomes above $10 million and a marginal 70% tax rate:

I guess if one is clearing $50 million, the two become pretty close…

Check out the spreadsheet here: AOC tax plan marginal vs average tax rate