House and Senate Republicans have passed a major tax bill. It makes big changes to how the government taxes its citizens. Most notably, corporations and some individuals will pay less tax (corporate rate lowered to 21%, lower individual brackets, higher standard deduction), but many deductions like the state and local deduction and personal exemption will be limited to pay for it and the deficit will likely go up.

How would this affect you? Is the backlash against certain Republican lawmakers in high tax states like California fair? Do I sense a spreadsheet in the making? After 3 prior tax posts including How to Estimate Taxes, a Marriage Tax Penalty Calculator, and an analysis of the Trump Tax Plan, you would think we had suffered enough…but here we go!

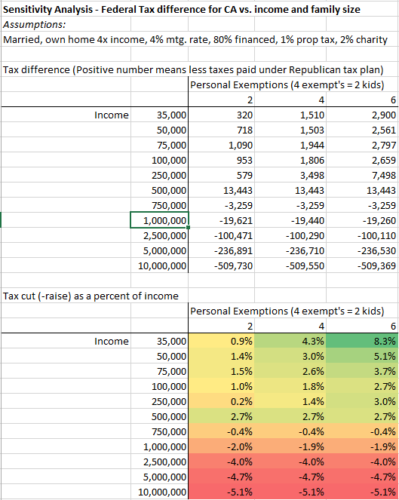

Sneak Peak – Our results indicate that married Californian homeowners making under about $700k are better off under the new plan, while those making over $700k are worse off. Disclaimer – this is really complicated, we might have made some errors (please let us know if you see any), and your mileage may definitely vary:

Spreadsheet Inputs and Simplifications

Calculating the effect of tax changes is remarkable complex – we’ll be making a lot of assumptions. We’ll focus on a married couple, set kids as an input variable, and focus on the impact of just the major changes: new brackets, limitation of the state and local tax deduction, AMT changes, and higher standard deduction/elimination of the personal exemption. We’ll ignore some complicating factors that we think have a smaller impact – that is the essence of modeling!

Our spreadsheet inputs include:

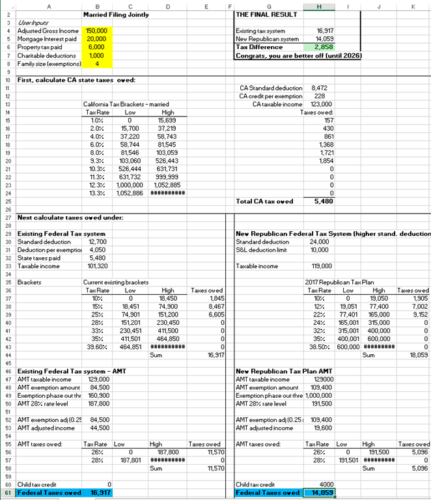

We start with cells for the user to enter their Adjusted Gross Income, mortgage interest paid, property taxes paid, and charitable/other deductions:

Current tax brackets and new tax brackets proposed under the tax plan. These are entered similarly to our past tax posts:

The standard deduction goes from $12,700 to $24,000

Personal exemptions that existed before would go away. We’ll have a space to enter personal exemptions (4 for our hypothetical family):

Okay, here’s where it starts to get complicated. The state and local tax deduction goes away, We need to add in a section that calculates state and local tax. We’re going to assume you live in California and add in those brackets

And adding even more complication, to really make this fair, we needed to include an AMT calculation, as many higher earners in CA were likely to fall under the AMT. The thresholds for AMT changed, but AMT still exists after the tax bill (despite certain promises…).

Spreadsheet Logic

Okay, usually we walk step by step through how we built the spreadsheet. This spreadsheet was pretty complex and this part would have taken up an inordinate of space (and brain damage). To learn about how we did it, just open the file and walk through some of the formulas…basically we calculated CA tax due, then calculated federal tax due under the two systems, then AMT due under the two systems, then added the updated child tax credit (Thanks, Marco Rubio..). Hopefully we didn’t make too many errors, let us know in the comments how you’d do it differently!

Download here: Will Californians pay more or less taxes under the new Republican Tax bill?