We’ve had four years to mentally recover from building our analysis of the tax effects of the Tax Cuts and Jobs Act (TCJA) on a family in California. That post and the (extremely free and educational) downloadable spreadsheet highlight the power of spreadsheets and problem solving: we can figure out exactly what the tax change would be on a family in California.

Rather than guessing and hand-waving at the net effects of the bracket changes, AMT changes, and State and Local Tax (SALT) deduction changes, we showed that taxes would go up on California families earning over $700k.

So here we are again, with the House passing a version of the Build Back Better legislation, which includes an increase in the SALT deduction limit from $10k to $80k. Senator Sanders calls this a “tax break for the rich”.

We updated our spreadsheet with a third series of columns calculating federal taxes for our hypothetical California family (owns home worth 4x income, 3% mortgage, 1% property tax, 1.5% charity, etc. – you can change your assumptions as you wish) with the $80k SALT deduction. Usually on this website, we walk through step by step how the spreadsheet was built, but it is a little too involved here and easier for you to download the spreadsheet.

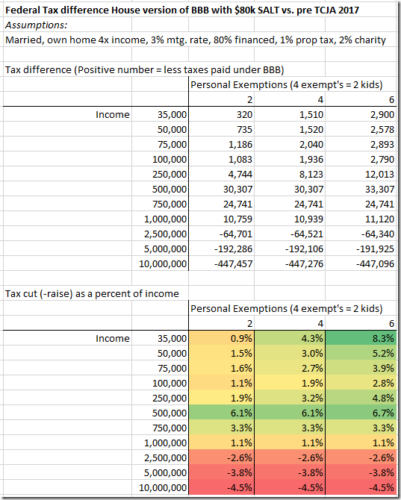

The first conclusion is yes, higher-income families benefit from the increase in the SALT cap. Generally, the benefit starts around $200-250k and maxes out around $1MM in income around $27k in tax savings:

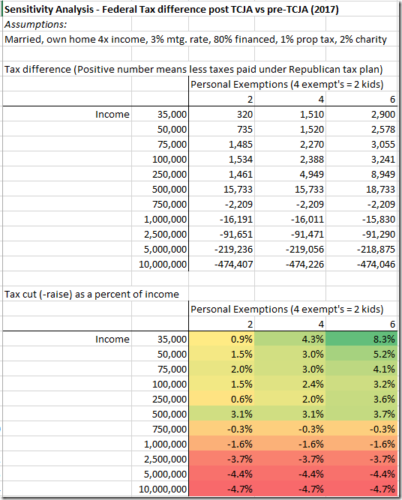

But, let’s not forget that when TCJA was enacted and the SALT deduction was capped at $10k, these same higher income families in higher tax states faced a massive tax increase while taxes were cut everywhere else. For example, at $2.5MM income the tax increase was $92k, or about 3.7% of income:

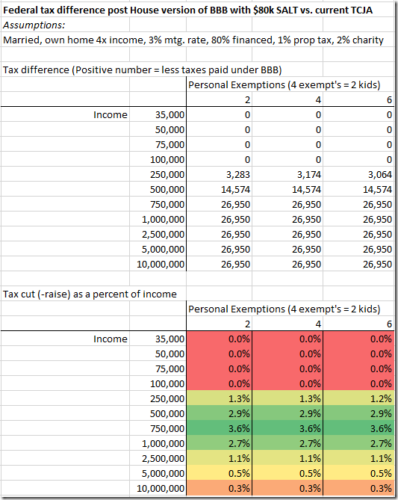

Finally, if we look at the net effect of how taxes on higher income families in high tax states are doing after the House BBB SALT cap increase to $80k and TCJA together, there is still net a big tax increase on the rich, but slightly reversed by this legislation:

Download the spreadsheet here: Spreadsheet Solving BBB SALT Cap Analysis