Summer and Fall are generally regarded as “Wedding season,” a time when love and celebration are in the air. December, on the other hand, could be regarded as “Should we get legally married for tax reasons before the end of the year” season, a slightly less romantic affair.

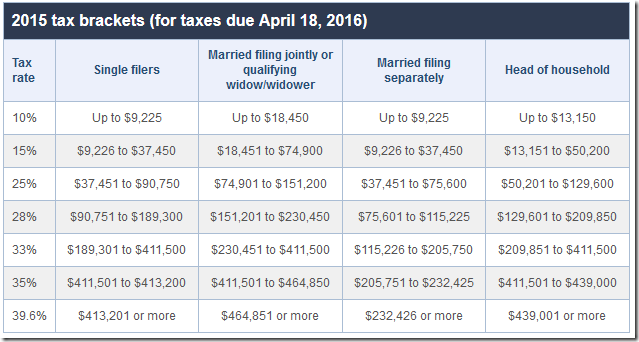

The US tax code is complicated in many ways – one of the ways is that when two people file jointly, the tax brackets do not scale up as if each one filed separately. I’m not sure how the IRS decided on where to make the cutoff for each bracket (much like the thousands of other tax rule quirks), but the result is that getting married and filing jointly may cause you to either pay more or less depending on each spouse’s income (from bankrate.com)

Here we go:

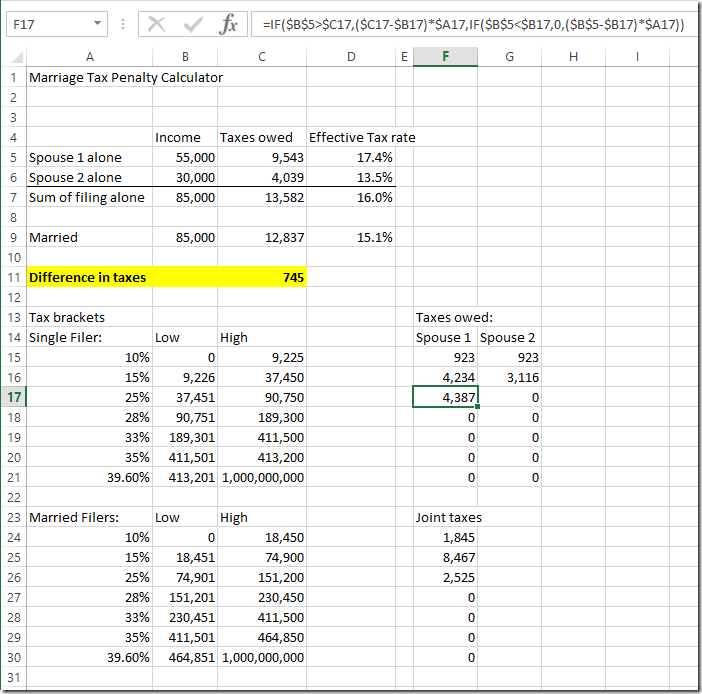

Spreadsheet Inputs: Each person’s income, IRS tax brackets (above)

Spreadsheet Outputs: How much federal tax the couple would pay as two single filers, and how much tax paid as Married filing jointly

Spreadsheet Logic: We covered how to calculate taxes owed in the post How to Estimate Taxes with Spreadsheets

We calculate taxes owed for each individual filing separately, and then for the combined income filing jointly. The formula looks long and ugly, but it basically says: 1) If the income is above the bracket’s upper cutoff then multiply the tax rate by the full bracket. 2) If the rate is below the bracket’s bottom cutoff put a 0. 3) If it is in between, multiply the bracket rate by the amount income is above the lower cutoff:

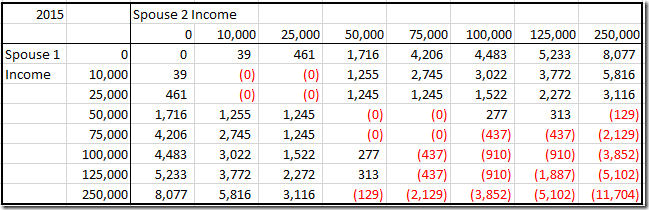

Then we can build a Data Table to see a lot of different scenarios of Spouse 1 and Spouse 2 income at once, and whether they would have lower taxes being married or single. The negative numbers indicate how much more you would pay in taxes if you are married versus if each person was filing as Single. This leads us to an interesting finding – generally if both spouses make about the same, you would be slightly worse off filing as married. Also, the higher each person’s income, the worse off they are tax-wise of filing as married. However, the benefit of filing married increases with income if one spouse is not working:

Here’s the Excel spreadsheet: Marriage Tax Penalty