House and Senate Republicans have passed a major tax bill. It makes big changes to how the government taxes its citizens. Most notably, corporations and some individuals will pay less tax (corporate rate lowered to 21%, lower individual brackets, higher standard deduction), but many deductions like the state and local deduction and personal exemption will be limited to pay for it and the deficit will likely go up.

How would this affect you? Is the backlash against certain Republican lawmakers in high tax states like California fair? Do I sense a spreadsheet in the making? After 3 prior tax posts including How to Estimate Taxes, a Marriage Tax Penalty Calculator, and an analysis of the Trump Tax Plan, you would think we had suffered enough…but here we go!

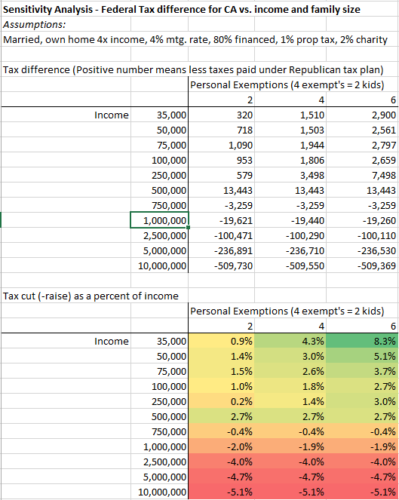

Sneak Peak – Our results indicate that married Californian homeowners making under about $700k are better off under the new plan, while those making over $700k are worse off. Disclaimer – this is really complicated, we might have made some errors (please let us know if you see any), and your mileage may definitely vary:

Continue reading “Will the Tax Cuts and Jobs Act make you pay more or less in taxes?”

Continue reading “Will the Tax Cuts and Jobs Act make you pay more or less in taxes?”