We’ve just hit week 4 of coronavirus-related working-from-home. Hope everyone is staying safe and staying home if you are able. One thing I’m starting to miss is workplace banter – conversations about TV shows, sports, and celebrity net worths. This post was also inspired by a blog post from Root of Good detailing their net worth progression between 2004 and 2014. In any case, it seems the fascination/financial voyeurism of guessing people’s net worth is widespread, and we’ve built a spreadsheet for the job.

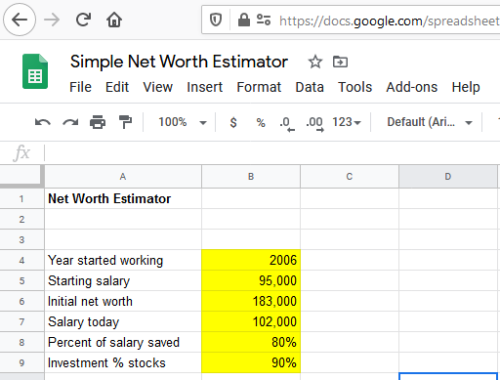

Spreadsheet Inputs

So, here we have another “essence of modeling” problem. We could make our spreadsheet hopelessly complicated and precise with detailed inputs for tax rates, investment allocation, debt, and spending, etc. I’m making the choice to make the spreadsheet be as simple as possible. Our 6 inputs will be:

- The year you started working and your starting income. (Or check glassdoor.com to estimate someone else’s).

- Your initial net worth – some people have a head start

- Your income now – I’m going to assume that you’ve worked every year and your income has gone up (hopefully) in a straight line fashion to today.

- The percentage of your gross salary you saved each year. The Root of Good appears to have saved around 70-80% of their income. It appears the national average is closer to 8%.

- How aggressively you invested your savings (%stocks vs %cash). I’ve input the annual returns from stocks using this helpful data from slickcharts

We’ll go with Google Sheets for today’s spreadsheet, and just for fun, let’s try to replicate the Root of Good’s numbers:

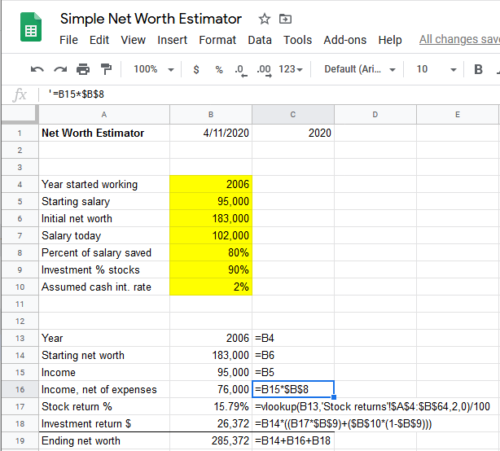

Spreadsheet calculations and output

In our spreadsheet, we begin with our inputs for the first year. Each year we take the starting net worth, add the income net of expenses to it. We then look up what stocks returned that year and calculate the investment return from their beginning net worth. We add it all together to get the ending net worth for the year:

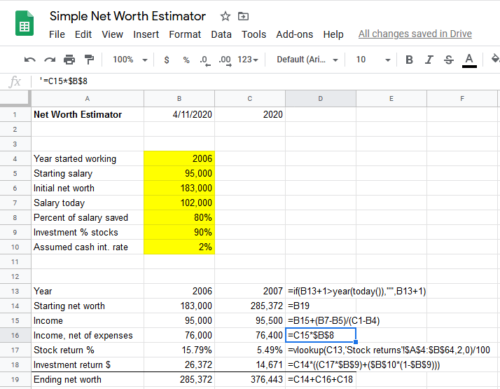

For each future year, we’ll increase the year by one (until we get to the current year), increase income in a straight line between their current and final income, and add the relevant investment return:

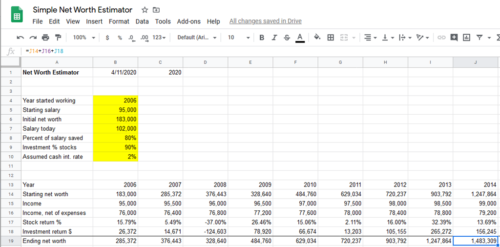

Then we can paste in the formulas from column C into the right columns:

Our spreadsheet would have predicted Root of Good’s net worth in 2014 was $1.48 million. Their post indicated it was $1.35 million. Pretty close for just the few inputs that we used!

Check out the link to our net worth estimator spreadsheet here to play with it yourself. Remember, you can save a copy to your own Google Drive by going to File –> Make a Copy.

It would be a fun exercise if you (anonymously) posted in the comments what the spreadsheet calculated for you versus your actual net worth. That data would be tailor-made for an xy-scatter plot.