With summer starting, we thought it would be helpful to put all of our math worksheet generator spreadsheet posts into one (somewhat) organized list. We’ve been creating these spreadsheets over the past three years to help supplement math learning for our own kids.

Note that all of these spreadsheet generators are done in Microsoft Excel. In order to use the free Google Sheets software, you can download and save the .xlsx file onto your computer, go to Google Sheets, and then hit File->Import-> Upload, and select the file. It might need some minor formatting/fitting to print.

Math Worksheets

General Math Worksheet generator – allows parent to set the maximum number size, and what operation, generates a random math worksheet: random math worksheet

Fill in the blank Math Worksheet generator – similar to the prior math worksheet, but instead of figuring out the sum in a standard (addend + addend = sum) problem, one of the three is randomly blank and the student fills in the blank: Math Worksheet generator

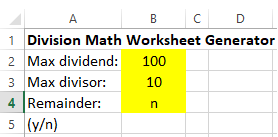

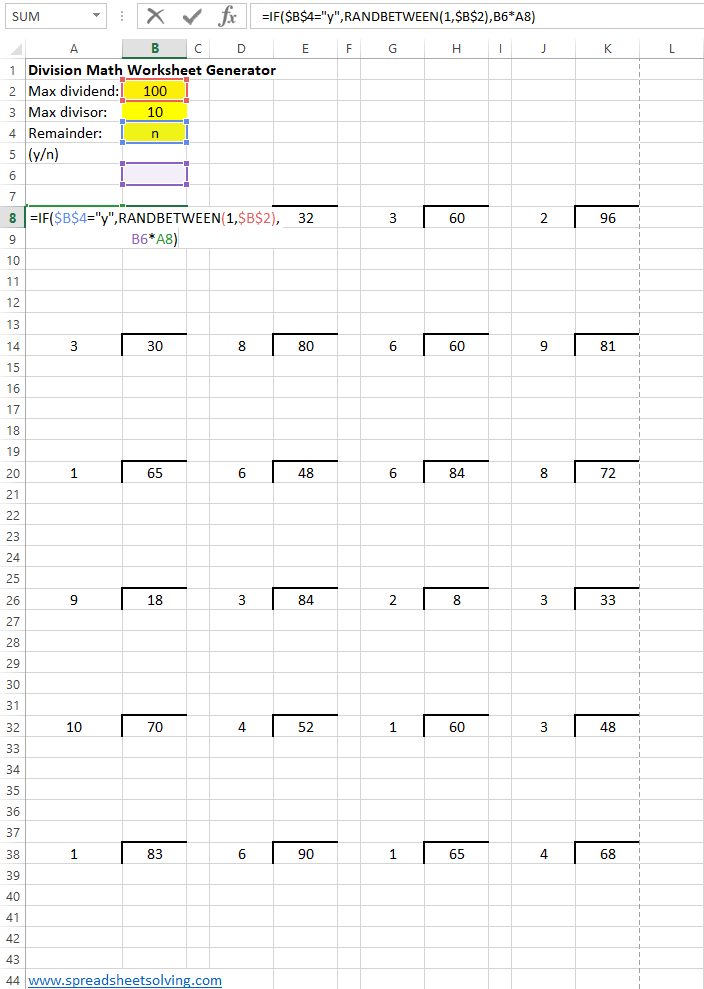

Division Math Worksheet generator – the logic and format for a division math worksheet generator was slightly different from the previous: Division Math Worksheet

Addition and Subtraction Math Facts speed spreadsheet – similar to the general purpose spreadsheet but designed to be a speed test of addition and subtraction math facts: Addition and Subtraction Math Facts Speed Worksheet

Number sequence pattern math worksheet generator – here you have a sequence of numbers and can choose spacing, number size, number of blanks for the student to fill out: Number Sequence Pattern Math Worksheet

Math Dice style worksheet – students try use math functions on the randomly generated input numbers to get to the answer number: Math Dice Worksheet

Practice with time math worksheet generator: Time Math Worksheet

Math word problem worksheet generator – this one is a bit crude, but perhaps someone could expand upon it: Math Word Problem Worksheet

Printable Flash Cards

General Purpose Flash Cards with user input and double sided printing: https://spreadsheetsolving.com/create-and-print-physical-flash-cards-with-this-microsoft-excel-template/

Addition and subtraction with math facts under 20 – Here we use our general purpose flash cards spreadsheet and enter in some math facts that students should have memorized: https://spreadsheetsolving.com/printable-math-facts-flash-cards-for-single-digit-addition-and-subtraction-with-carrying/

Multiplication Flash Cards: https://spreadsheetsolving.com/printable-multiplication-flash-cards-spreadsheet/

Division Flash Cards: https://spreadsheetsolving.com/printable-division-facts-flash-cards-spreadsheet/

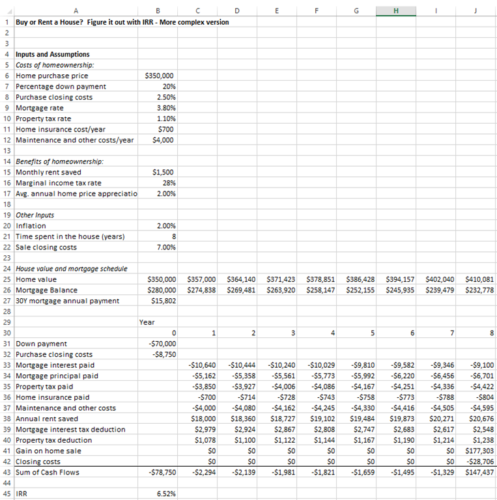

What are your new year’s resolutions? As in most cases, coming up with the goals is easy…but achieving them is another story! According to a

What are your new year’s resolutions? As in most cases, coming up with the goals is easy…but achieving them is another story! According to a