One of the more amazing things I’ve encountered while studying finance is the Rule of 72. This rule effectively tells you how long it would take to double your money, depending on what interest rate you are earning on it. So if you were earning 4% a year, it would take roughly (72/4) = 18 years to turn $1,000 into $2,000.

But does it really work? Let’s verify with a spreadsheet!

Spreadsheet inputs

This is a pretty simple spreadsheet, with the only inputs being the interest rate and the starting amount of money.

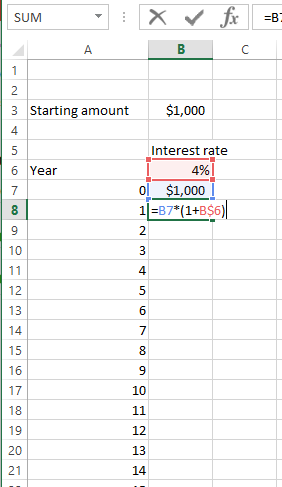

Spreadsheet logic

Now we add a column that keeps track of the number of years. For each year, we put in the formula to grow the amount of money by the interest rate. This is done by multiplying the starting investment balance by (1 + interest rate).

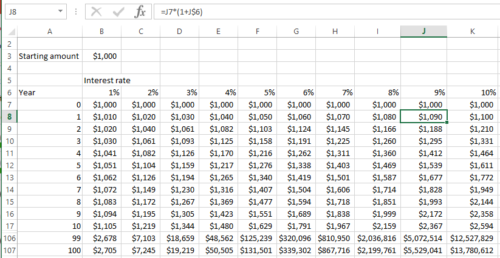

Now we paste that formula down to year 100. We can also add a column for each interest rate between 1% and 10% and paste our formulas over:

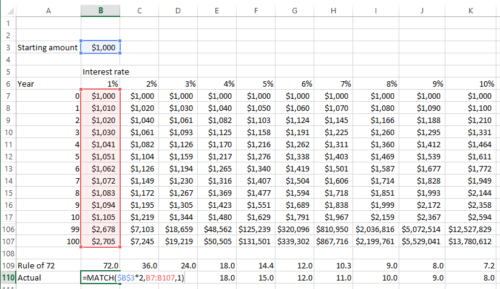

Finally, we can check to see how close the actual time it takes our money to double versus the number predicted by the Rule of 72. Let’s enter the formula for the Rule of 72 which is (72 / interest rate*100). Then we use the MATCH() Function to tell us what year the total gets to $2000. It’s pretty close!

Feel free to access the spreadsheet: Rule of 72