One of the ideas floating around lately is that if you were lucky enough to secure a low interest rate, it is actually a hidden asset in your net worth.

Of course, it’s a little more complicated than that, for example if you move/sell you have to repay your mortgage and that asset would disappear, which is not what typical assets actually do.

But let’s have some fun for a moment and pretend that by borrowing at a low rate we have effectively shorted a 30 year bond, and see how much value we have generated by this trade.

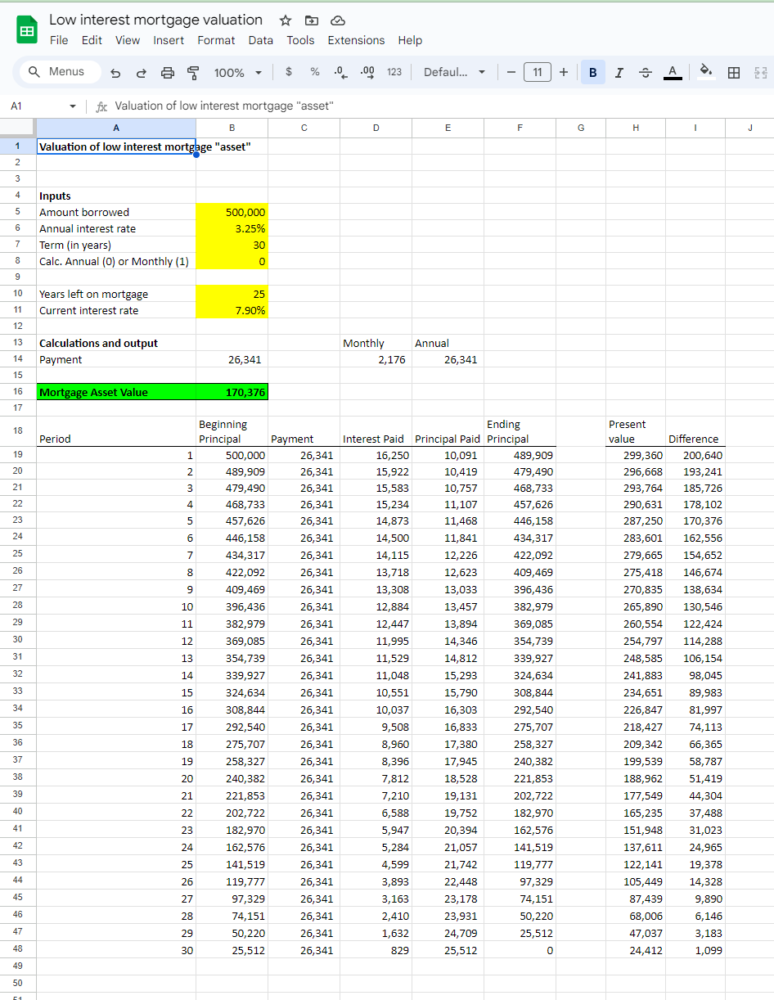

We’ll repurpose our debt amortization spreadsheet from an earlier post.

All we need to do now is to to add a few additional inputs – how many years are left on the mortgage, and what the current mortgage rate is. We’ll then calculate the net present value of the remaining mortgage payments for each year using the current mortgage rate as the discount rate. The difference between that NPV and your mortgage principal is the “asset value”.

In this example, in year 5 on an original $500k mortgage at 3.25%, the “asset value” of keeping this mortgage when the current market mortgage rate is 7.9% is $170k!