We’ve updated our original Marriage Tax Penalty Spreadsheet using the new brackets from the Republican Tax Plan. Having done the original in a spreadsheet, all we had to do was copy the whole sheet over, and then adjust the numbers in columns A to C according to the new tax brackets, and update the data table. Easiest post ever!

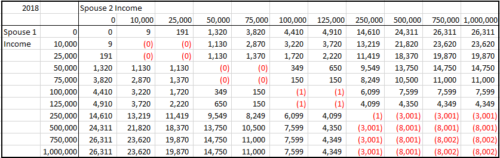

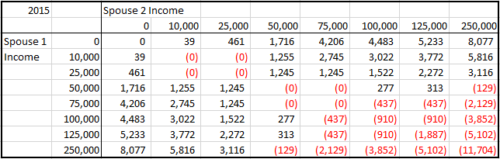

Somewhat surprisingly, the new Republican tax brackets are quite beneficial for higher income married working couples, as it mostly eliminates the marriage tax penalty for those earning less than $600k combined (previously they kicked in when both people were making around $75-100k). The married brackets now are just generally double the individual brackets, except for a kink around the $500k-600k range.

Here’s the new data table showing the penalty (negative number) or benefit (positive number) with the new brackets:

As a reminder, here were the old marriage penalties (negative) and benefit (positive):

Check out our updated spreadsheet here: Marriage tax penalty (2018) spreadsheet