Finance hiring is down, law school grads are having a tough time finding real law jobs, so what is an ambitious but risk averse college student to do with his or her life these days? Okay, right now the answer is computer science. Yes seriously, do computer science. But let’s pretend it is the year 2001 and the only other option respectable option is medical school. But doesn’t med school take a lot of time (4 years school plus 3-7 years residency/fellowship) and cost a lot of money? How can we figure out if going to med school and not earning doctor money until 7 years from now is worth it financially relative to just entering the workforce and working for those 7 years?

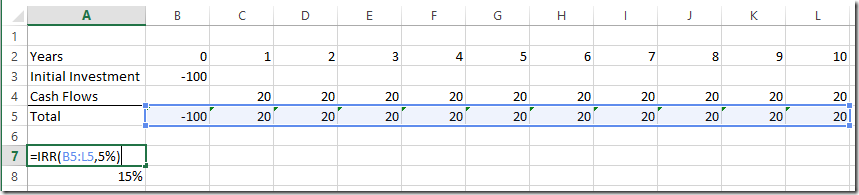

Internal rate of return (“IRR”) is a concept in corporate finance to evaluate how good an investment is. IRR looks at all the cash flows of a project and calculates the interest rate earned from investing in that project. This concept is explained better from Investopedia, but the best way to understand it is to see how it gets calculated in a spreadsheet. We can set up a spreadsheet for a hypothetical investment with an initial investment of $100 and $20 of cash flows each year for 10 years. Intuitively, while the investment pays you back $200 for your $100, because it happens over 10 years, the average effective annual return is 15% as seen here:

Now we look at med school:

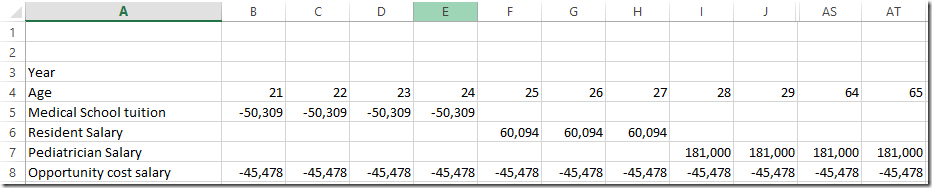

Spreadsheet inputs:

We can evaluate the decision to go to med school as a series of cash flows over one’s education/career, where the alternative is to work in a normal job. For our example, let’s assume our future doctor is going to become a pediatrician – which requires just 3 years of residency and no fellowship. Cash flows we will track include:

1. The cost of tuition – According to this article, the median cost of tuition and fees for medical school was $50,309 per year.

2. Income during residency – According to Glassdoor, the national average salary appears to be $60,094

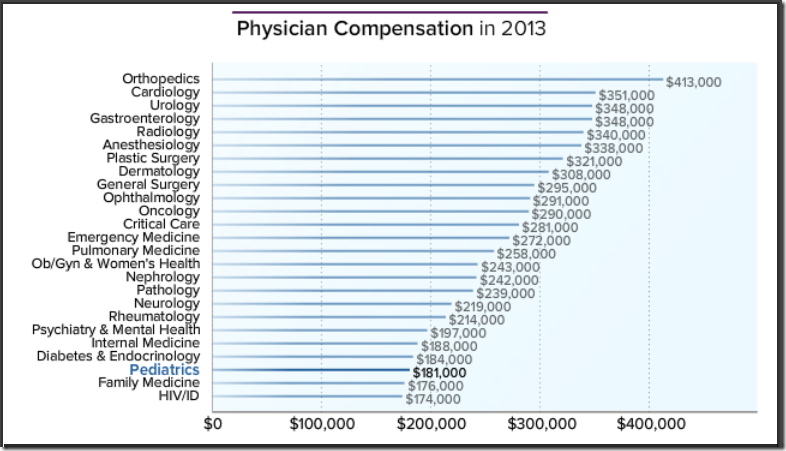

3. Income once residency is completed and you become a pediatrician – This chart was obtained from Medscape.com, Pediatrics appears to pay $181,000 on average:

4. The opportunity cost of going to med school: By going to med school, you are forgoing the income that you would have earned during med school, residency and throughout your career. On average, recent college grads earn $45,478 according to a survey by Time.com. We note that if someone is qualified to go to med school, they probably have better earning prospects than the average, but as we’ve said before the beauty of spreadsheets is that you can enter any different inputs that you want once a spreadsheet’s problem solving logic is set up.

5. Other inputs – we assume the college grad is 21 and plans to work until age 65, and we will ignore inflation and taxes for simplicity

Here’s what our spreadsheet looks like so far:

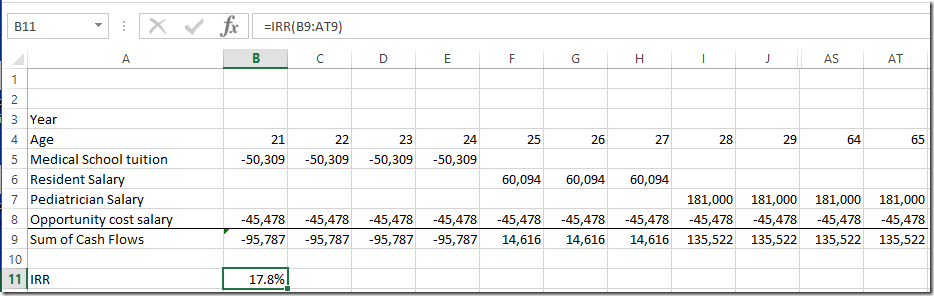

Spreadsheet Output:

The logic is pretty simple here, and the same as our simple example. We sum up the cash flows and use the excel function =IRR(values, guess) on the cash flows to determine the IRR:

The IRR of going to med school according to our assumptions is 17.8%, which is really good as far as investments go (especially when treasury bonds only pay 3% and stock expected returns are 6-8%). Also, being a doctor might lead to a more rewarding career and doctors appear somewhat more immune to job loss from technological change and outsourcing, which aren’t taken into account here.

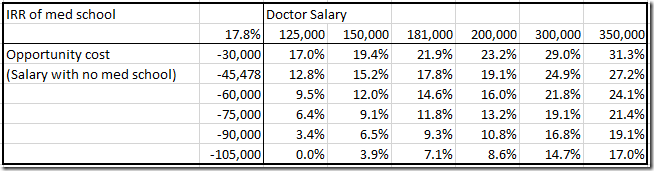

Just for fun, here’s a data table showing the sensitivities of IRR versus the starting salary one could make coming out of college and the doctor’s salary after residency:

To download the Excel spreadsheet, click here: Medical School IRR Calculation

I have a question where can i contact you?

Feel free to reach out to us at spreadsheetsolving@gmail.com.