“The more you give, the more you get, that’s being alive” – The Money Song, Avenue Q

Charitable giving serves a valuable purpose in our society. It allows organizations in health, education, social services and others to provide benefits to people who otherwise couldn’t afford them. It allows people who have built up wealth to give back and make a difference. The federal government even subsidizes charitable giving by allowing donations to be deducted from income reported for taxes (effectively kicking in up to 39.6% of each donation). It’s a great system that is meant to fund those people and organizations in need. At least that is how it should be.

A charity that operates efficiently is one that turns the majority of their donations into public good. But charities tend to fall on a wide spectrum for efficiency. A poorly run charity might pay their executives exorbitant salaries, have fancy offices, and perhaps pay a marketing company a large amount to generate donations, all of which results in a smaller percentage of funds actually going to help people. Bad charities are out there, here’s a site that lists the worst offenders.

So how do you figure out if the organization you are giving to is using your money wisely?

Like everything else on this website, the answer is looking at the raw data and using a spreadsheet to analyze it. Alternatively, an easier way is to get guidance from the groups that are doing the very important work of vetting charities, such as Charity Navigator, GiveWell and Charity Watch. However, we feel that there is a certain satisfaction of seeing the raw data and doing it ourselves…

Spreadsheet Inputs

Every nonprofit is required to file an annual Form 990 with the IRS. This form gives the IRS an overview of the organization’s activities, governance information and financial information. There are a few sites that allow you to search for the filings – our favorite is foundationcenter.org.

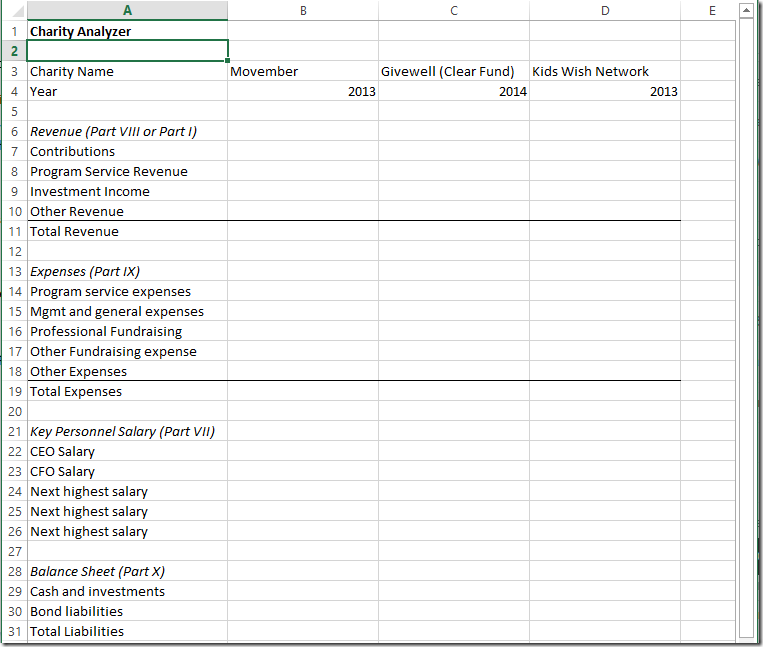

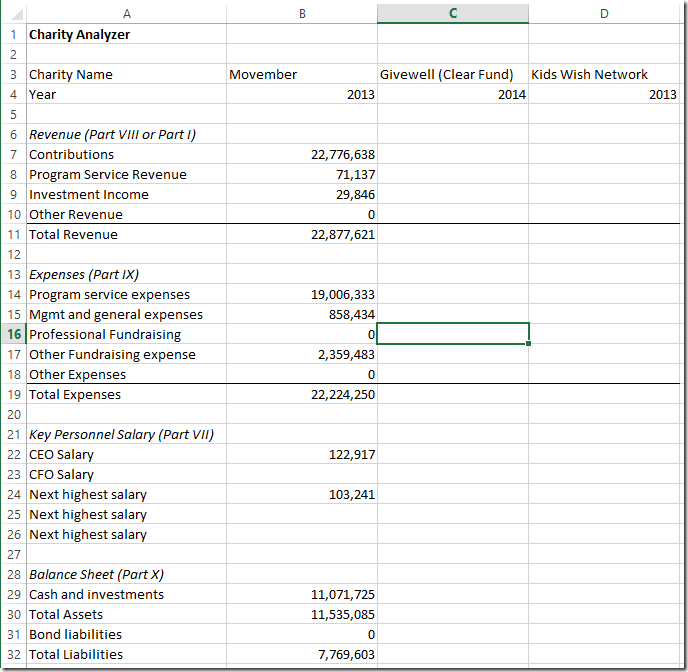

The Form 990 looks complicated on the surface, but we can just focus on just a handful of key data points: Revenues, Expenses, and Key Employee Salaries. We will build a spreadsheet that stores this key information and calculates some basic ratios to help us get a better sense of how the charities operate. We’ll do it for a handful of popular charities, which will allow us to compare them with each other. Here’s a first pass of what the setup of the spreadsheet might look like (but the beauty of making your own spreadsheet is that you can customize it how you want it):

We’ll use the Movember 2013 Form 990 as an example

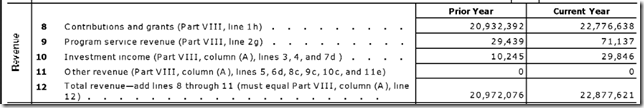

1. Revenue – This is found in the Summary Part I or you can get a more detailed version in Part VIII

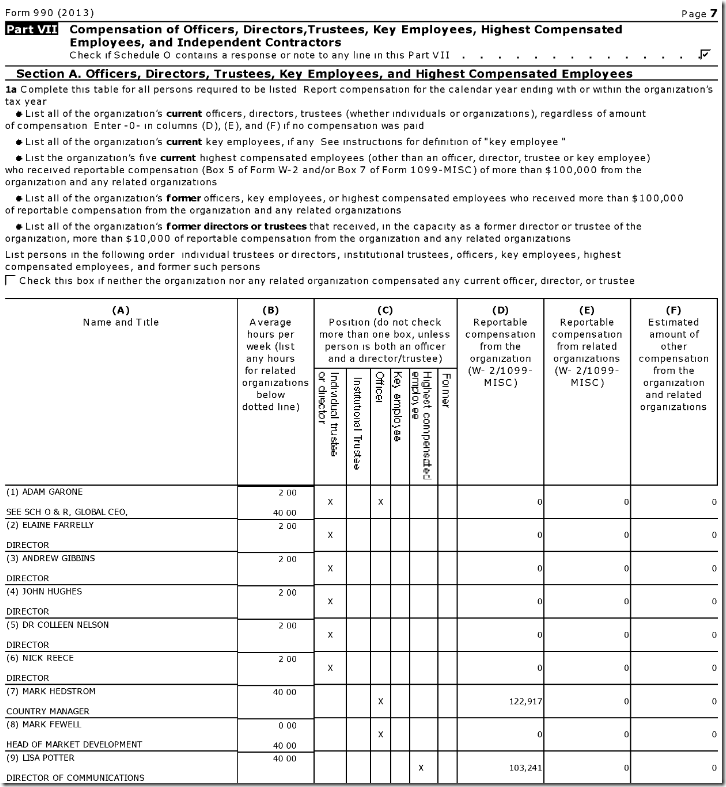

2. Key Employee Salaries – This can be found in Part VII:

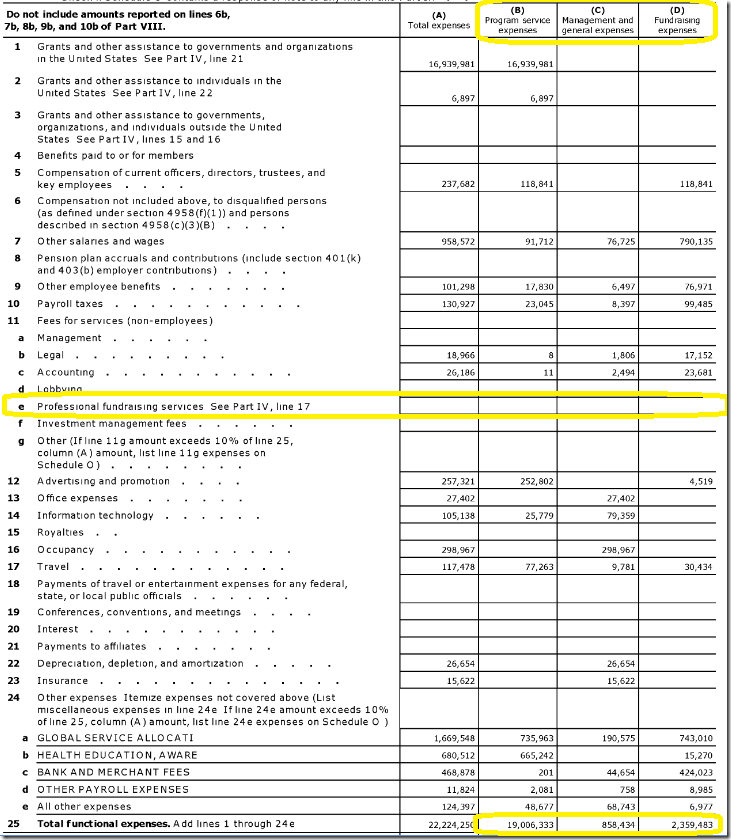

3. Expenses – While expenses are listed in the summary Part I, and have professional fundraising fees broken out, Part IX has a more useful breakout between Program service expenses (used directly for the charity’s purpose), Management and general expenses (used to run the charity), and Fundraising expenses (used to generate more donations):

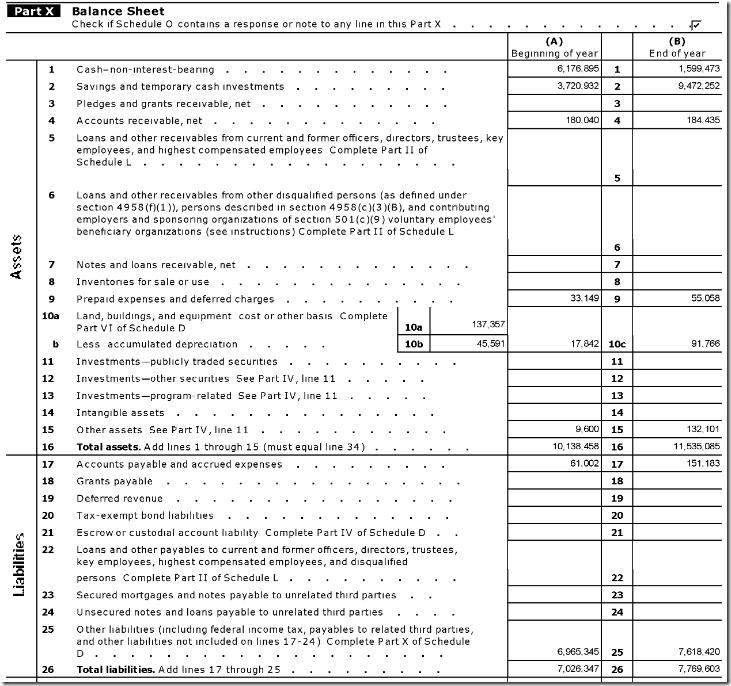

4. Balance Sheet – This provides a snapshot of the charity’s financial resources and obligations:

After filling this information in, our spreadsheet looks like this:

Spreadsheet Outputs

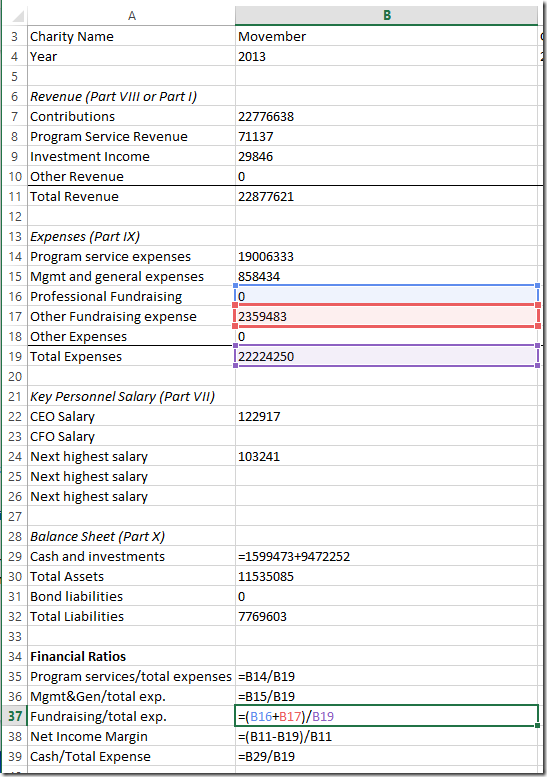

Now that we have taken the raw data from the Form 990, we can calculate some ratios to gain some insights into the numbers. Here’s a few (by no means an exhaustive list) that come to mind:

Program service expenses/Total expenses: What percentage of the charity’s spending is on actual charity?

Management and general expenses/Total expenses: What percentage of the charity’s spending is on administrative costs?

Fundraising expenses/Total expenses: What percentage of the charity’s spending is on fundraising?

Net income margin (Total Revenue – Total Expenses)/(Total Revenue): How much of the charity’s annual revenue is being spent? While for-profit companies would like this ratio to be as high as possible, a charity should probably be operating near breakeven.

We thought about putting a CEO Salary/Revenue ratio but that doesn’t really make sense for a non-profit. CEO salaries should be benchmarked against other salaries in the industry to see if they are fairly compensated.

Cash/Total expenses: How large is the cash buffer relative to total expenses? While a charity should have a cash buffer to guard against potential leaner future donations, an excessive amount of spare cash is somewhat of a red flag. It could mean that the charity has run out of charitable things to spend it on, meaning your future donations to the charity might sit idly doing nothing. Yes, I’m looking at you, wealthy universities: See Why don’t elite universities expand their enrollment?

Here’s how our sheet looks now, with the formulas displayed (Ctrl + ~):

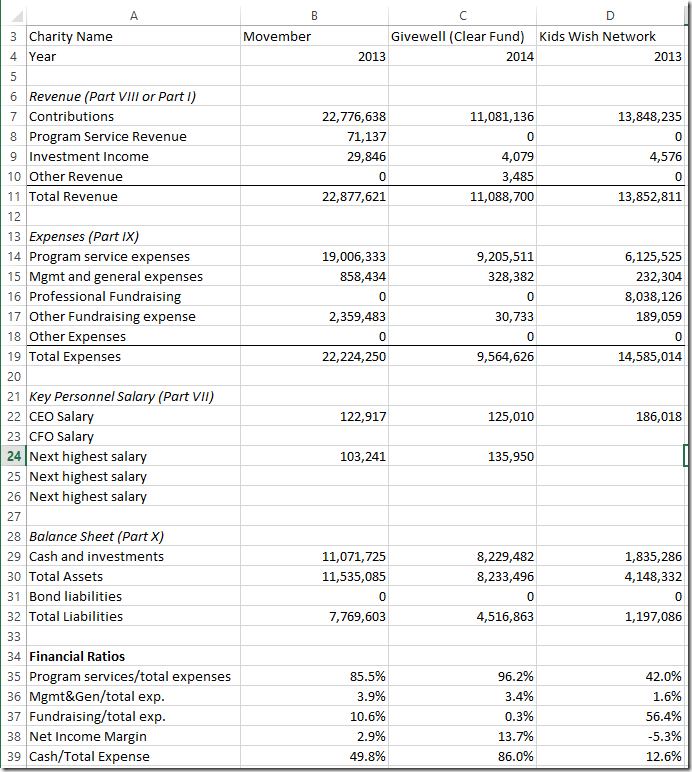

We went ahead and filled out the Form 990s for Givewell and Kids Wish Network to compare with Movember. Kids Wish Network was the #1 worst offender in the Tampa Bay times article earlier in this post, and by comparing it to the other two charities we can easily see why. Here is the final spreadsheet: Charity Spreadsheet Analysis