According to Scholastic, the recommended age to start giving kids an allowance is around 5-6 years. As parents of kids around that age, this makes sense: our kids are learning about coin values in school and starting to ask questions like “why can’t I buy a museum gift shop stuffed animal when you just spent four times that amount on groceries?”

With this newfound weekly cash flow, it’s a good time to introduce the concept of spending vs. saving, which is the cornerstone of many personal finance websites. When kids save, I suppose they could just keep the cash in a jar, but a more effective teaching tool would be to have them deposit it in the “Bank of Mom and Dad”, for not only safe-keeping, but also to earn an interest return on that saved money. The hope would be to illustrate the value of saving and for that savings to be “put to work” in generating even more money for them from interest.

Spreadsheet Inputs

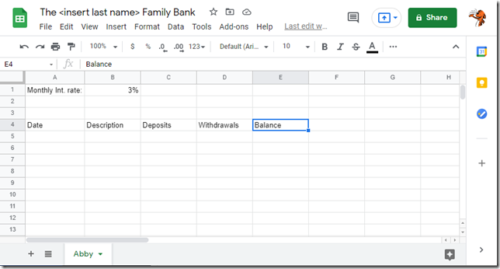

We’ll use Google Sheets for today’s spreadsheet with the thought that we’d like our kids to view the spreadsheet (but of course not edit…).

We’ll set the spreadsheet up like one of the old “passbook accounts” that I had as a kid (and from which my subconscious is likely drawing this post from):

We’ll also have an input for the monthly interest rate. This is an interesting decision as real monthly interest rates are perhaps only 0.04% and may not actually entice your child to save any money to earn no interest. I’ll put in 3% in our example. If little Abby finds a way to borrow a million dollars at 1% and put it in our bank, we might go bankrupt (although that’ll be promising for her Wall Street career…).

Here’s how our spreadsheet looks so far:

Spreadsheet Logic and output

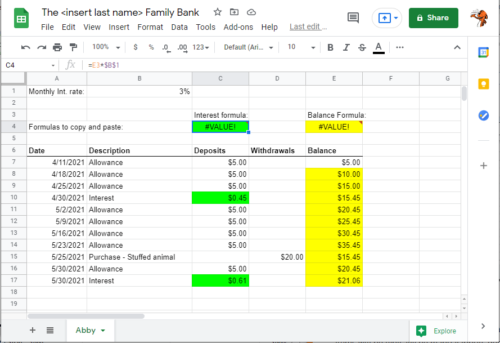

There’s not really much to the logic: the Date, Description, Deposit, and Withdrawal items will typically be manual inputs depending on what is happening (allowance, withdrawal to buy stuffed animal, gift from Grandma, etc.).

The balance will just be a formula (last balance + deposits – withdrawals).

For interest payments, the formula will go in the deposits. One complication is whether to pay a full month’s interest on money that was deposited during the month by just using the last balance for the interest payment. In the name of simplicity, I think that’s fine. If little Abby figures out a way to arbitrage you by putting a lot of money in on the 30th of the month and then taking it out on the 1st…her financial education would be complete.

Check out the spreadsheet here, The Family Bank. Save a copy by going to File – > Make a Copy

What are your new year’s resolutions? As in most cases, coming up with the goals is easy…but achieving them is another story! According to a

What are your new year’s resolutions? As in most cases, coming up with the goals is easy…but achieving them is another story! According to a